As Saudi Arabia announces it will cut oil production by 1 million barrels per day, Australian experts say it’s a dangerous game that could lead to legitimate supply chain shortages. as of June5/2023

Saudi Arabia has announced a voluntary oil production cut, saying it will take out 1 million barrels per day (bpd) of production from the world’s supply pool in July. That takes the country’s overall headline production to 9 million bpd, down from around 10 million bpd in May.

The OPEC+ (Organization of Petroleum Exporting Countries) group, which is a group of 23 oil-exporting countries led by Russia that meets to decide on how much crude oil to sell on the world market, is looking to boost lagging oil prices. The group is responsible for exporting around 40% of the world’s crude oil.

At the time of writing, Brent is trading at US$75.60 a barrel, but Commonwealth Bank’s director of Mining and Energy Commodities Research, Vivek Dhar, tells Forbes Australia this could topple to $85 a barrel in the fourth quarter of this year because of the production changes.

What happened to oil prices?

Global oil prices have fallen across the first six months of 2023, with Brent crude oil peaking in January at US$84 a barrel and falling to around US$75 a barrel today.

“There have been a lot of headwinds,” Dhar says. “People are concerned about global growth, and that has weighed on oil prices.” There also appears to be a surplus of crude oil, according to the OPEC+, and demand has pulled back as economic sentiment weakens.

Saudi Arabia claims that by cutting oil production, it’s preventing prices from getting too low. So, it’s superficially tightening the market and claiming to ‘stabilize’ it.

“This is a Saudi lollipop,” Saudi Energy Minister Prince Abdulaziz told a news conference. “We wanted to ice the cake. We always want to add suspense. We don’t want people to try to predict what we do… This market needs stabilization”.

What do Saudi Arabia’s oil production cuts mean for Australia?

The immediate impact of an oil production cut is higher oil prices in Australia, relative to otherwise. But there’s something else at play, Dhar says.

“You’re playing dangerously here,” Dhar says.

“The International Energy Agency last month was already forecasting markets to slip into a shortfall [of oil] later this year.

“That’s before the announcement from Saudi Arabia. But by cutting oil production, you may actually get into a physical shortage of oil later this year and that could see prices rise more than you’d expect.”

Now, Commonwealth Bank is forecasting $85 a barrel by Q4 of 2023. The impact of that is higher petrol and diesel prices across Australia.

“There are two factors that determine petrol and diesel prices,” Dhar says. “One is the international oil price, and the other is the Australian dollar. If the Australian dollar weakens, which is our view over the next quarter, and oil prices rise, this is indicative of where petrol and diesel prices will go.”

Will Saudi Arabia’s oil cuts have an impact on interest rates?

In short, not necessarily. Dhar says generally the Reserve Bank of Australia overlooks fuel prices as it is a very volatile component of the Consumer Price Index basket. Generally, fluctuating oil prices don’t affect interest rate decisions unless the oil price is sustained.

“Given that it has been volatile, I think it will likely be overlooked,” Dhar says. “But if it [higher oil prices] is sustained, then it becomes more entrenched in other parts of the economy. So it’s not really the petrol prices – it’s where the price starts to affect other parts of the economy, like transporting goods.”

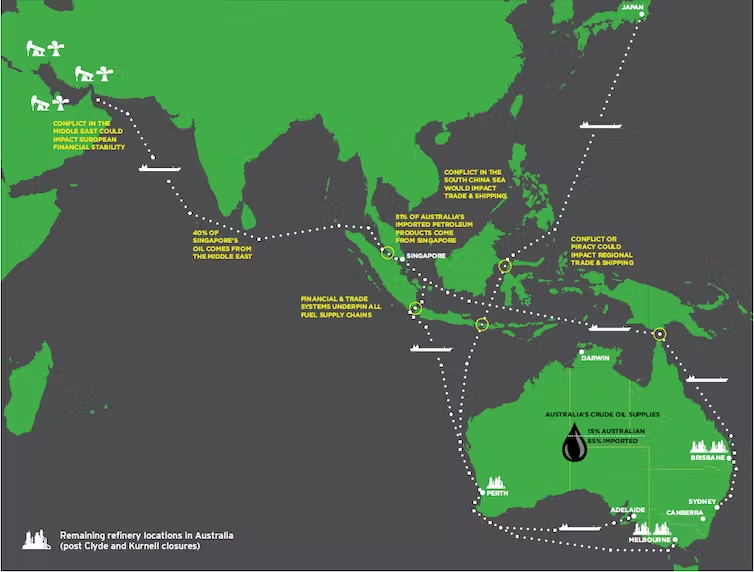

51-53% of our imported refined petrol comes from Singapore’s refineries, with 18% from South Korea, 12% from Japan and the rest from a range of other countries. Asian refineries are extremely competitive in terms of production and transport costs.

https://theconversation.com/australia-imports-almost-all-of-its-oil-and-there-are-pitfalls-all-over-the-globe-97070